Nigeria has seen one of Africa’s fastest changes in digital banking in recent years. Millions of Nigerians now depend on fintech to transfer money swiftly and securely for anything from mobile payments to online shopping and remote jobs.

However, despite the market’s abundance of platforms, consumers continue to encounter difficulties like expensive transaction fees, slow transfers, and subpar customer support.

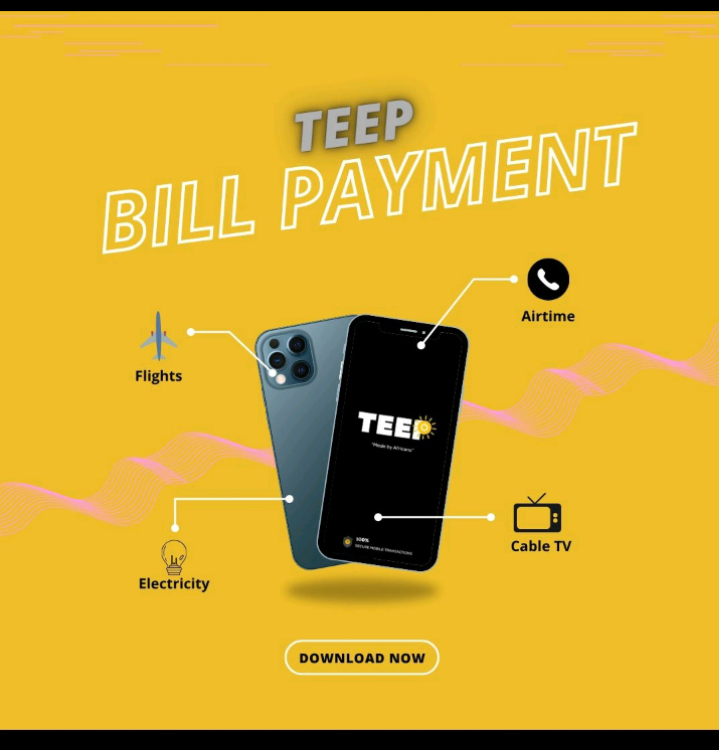

This is where Teep.Africa enters the picture.

Teep.Africa is a new fintech platform built to solve real problems Nigerian users face every day. It combines speed, affordability, and user-friendly design to create a simple financial experience that actually works for ordinary people and small businesses.

1. Digital Payments Are Now a Basic Need, Not a Luxury

More Nigerians are working online, running small businesses, and handling daily transactions digitally. Whether it’s paying bills, sending money to family, or collecting payments from customers, digital finance is now part of daily life.

Teep.Africa offers a platform that makes these tasks faster, smoother, and more reliable.

2. Nigerians Need Lower Fees and Faster Transfers

With inflation rising and the cost of living increasing, nobody wants unnecessary banking charges. Many people are tired of delays, failed transfers, and deductions they can’t explain.

Teep.Africa focuses on:

- Low transaction fees

- Instant payment confirmation

- Transparent charges

This makes it an ideal solution for people who want to save money and avoid banking frustrations. READ MORE