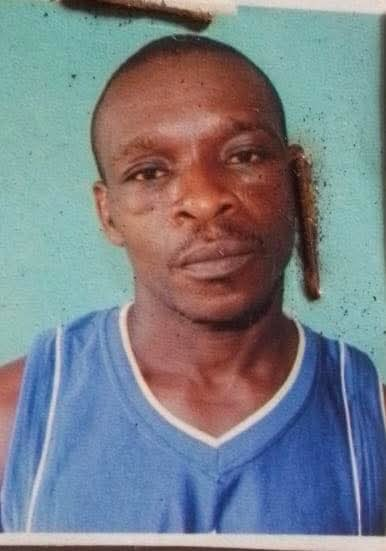

A British Virgin Islands (BVI) court has ruled that Ambrosie Orjiako, a former chairman and co-founder of Seplat Energy Plc, fraudulently concealed assets to evade a $220.3 million debt claim made by Access Bank.

The enforcement order, delivered by the judge, Abbas Mithani of the BVI Commercial Division, followed years of international litigation over a syndicated loan default dating back to 2013.

Access Bank’s claim presented before the court on 16 April 2024 was in consequence of an earlier judgement secured by the lender against Mr Orjiako at the High Court in England in March 2016. It set out primarily to implement the decision of the English court, according to a court document obtained by PREMIUM TIMES.

Access Bank had in April 2024 got a consent order, to which both parties agreed, from the British Virgin Islands court to enforce the ruling.

The subject of that suit was Mr Orjiakor’s obligation under the terms of a 2011 syndicated loan facility availed by three lenders, namely Afrexim Bank, Diamond Bank (now defunct after a 2019 merger with Access Bank) and Skye Bank (now Polaris Bank) to Shebah Exploration & Petroleum Co. Limited.

Shebah Exploration, owned and controlled by the one-time Seplat chairman, is currently under receivership. Mr Orjiakor is facing bankruptcy proceedings in Nigeria, Judge Mithani of the Commercial Division of the High Court of Justice of the Virgin Islands, said.

According to the latest judgement of the Virgin Islands court, Mr Orjiakor issued a personal guarantee as part of the security for the loan on which Shebah Exploration defaulted in March 2013.

The three banks demanded immediate repayment of the credit in September 2013. They also called in Mr Orjiako’s personal guarantee and the corporate guarantee that Allenne Limited, a British Virgin Islands company, pledged in respect of the same borrowing.

In 2014, the issue came up for hearing in England and was settled on agreed terms, even though Mr Orjiako later contravened the terms, forcing the banks to initiate another legal action against him. Breakthrough came two years later when they got a summary judgement against him.

“By May 2014, Dr Orjiako had been sued personally for $150m and settled that claim on the basis that he would pay the sums outstanding in two tranches, the first of which (for $50m) would be paid by 30 April 2014. However, in my judgement, the writing must have been on the wall for Dr Orjiako very substantially earlier,” Justice Mithani said on 1 October in his judgement.

“By at least March 2013, he must have known that he had no reasonable prospect of paying his guarantee liability to the Claimant. When he failed to make the two payments above, there would have been no doubt in his mind that he would be unable to do so without recourse to the Shares,” he added.