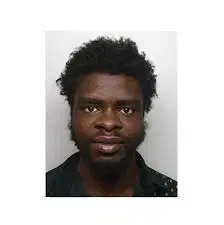

A 40-year-old Nigerian man, Oluwaseun Adekoya, was sentenced to 20 years in prison in Albany, New York for orchestrating a nationwide bank fraud and money laundering scheme.

Earlier this year, a jury found Adekoya guilty of bank fraud conspiracy, money laundering conspiracy, and nine counts of aggravated identity theft after a three-week trial.

Acting United States Attorney John A. Sarcone III and Craig L. Tremaroli, Special Agent in Charge of the Albany Field Office of the Federal Bureau of Investigation (FBI), made the announcement in a statement issued by the Department of Justice on Tuesday.

Proof at trial established that from the comfort of his luxury apartment in New Jersey, Adekoya, a career fraudster, obtained publicly available information regarding people’s home equity lines of credit (“HELOCs”) at localized credit unions throughout the United States, shifting his focus over time to different parts of the country to avoid law enforcement scrutiny.

He then utilized encrypted messaging platforms, like Telegram, to obtain Social Security numbers, account numbers, mother’s maiden names, and other personal identifying information (“PII”) for individuals he had identified as having substantial amounts of equity available in their HELOCs.

Adekoya then gave this information to a vast web of managers he recruited from all over the country, along with fake driver’s licenses for lower-level workers to use to impersonate the HELOC customers and conduct withdrawal transactions on their accounts.

To insulate himself from detection, Adekoya utilized a web of “burner” phones and encrypted messaging applications and laundered his substantial share of the proceeds through bank accounts in other people’s names.

Adekoya also reinvested some of the proceeds into continuing the fraud scheme by purchasing air and bus travel for coconspirators, fake driver’s licenses, and rental cars used to drive workers to credit unions.

Adekoya, a citizen of Nigeria, previously obtained lawful permanent resident status in the United States in 2004.

For more details visit